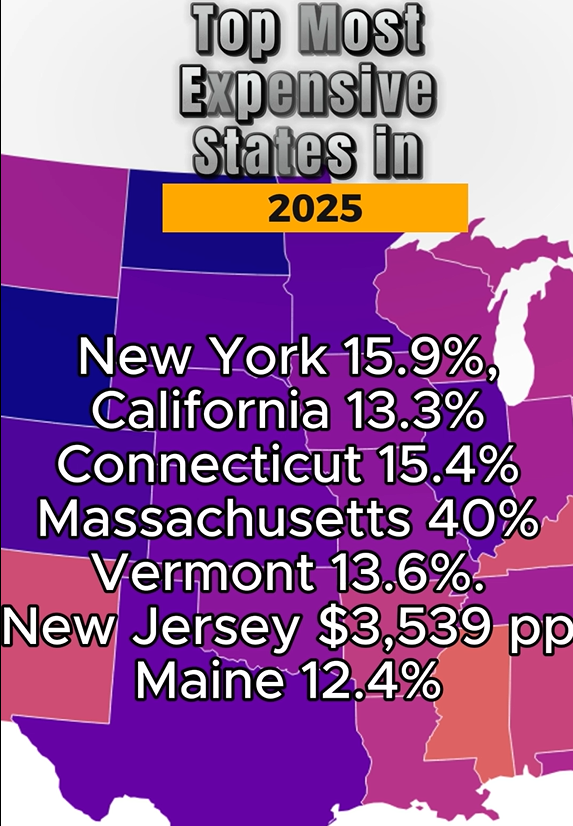

New York

- Housing Costs: Extremely high, especially in New York City, where even small studio apartments often exceed $500,000.

- Tax Burden: Highest in the nation at 15.9%, encompassing significant income and property taxes.

- Cost of Living: Elevated due to expensive housing, transportation, and general expenses.

California

- Housing Costs: Among the highest nationwide, with median home prices surpassing $1 million in cities like San Francisco and San Jose.

- Tax Burden: High, with a top individual income tax rate of 13.3%.

- Cost of Living: Driven up by housing shortages, strict zoning laws, and high construction costs.

Connecticut

- Housing Costs: Substantial, with ongoing challenges in affordability.

- Tax Burden: Second highest in the U.S. at 15.4%, including significant property taxes.

- Cost of Living: High, influenced by taxes and housing expenses.

Massachusetts

- Housing Costs: Notably high, particularly in the Boston metropolitan area.

- Cost of Living: Elevated due to housing, healthcare, and general expenses.

Vermont

- Housing Costs: High, with limited availability in certain areas.

- Tax Burden: Third highest in the nation at 13.6%.

- Cost of Living: Increased by taxes and housing expenses.

New Jersey

- Housing Costs: Significant, especially in areas close to New York City.

- Tax Burden: High, with property taxes averaging $3,539 per person—the highest in the U.S.

- Cost of Living: Elevated due to taxes and housing costs.

Maine

- Housing Costs: High, particularly in desirable coastal regions.

- Tax Burden: Ninth highest at 12.4%, including estate taxes.

- Cost of Living: Increased by taxes and housing expenses.